Personal Loan Stacking

Access Larger Funding by Combining Multiple Personal Loans

Access Large Amounts of Capital

Personal Loan Stacking

Personal loan stacking allows business owners to combine multiple personal loans to access larger amounts of capital, providing fast funding for business needs when traditional financing options are limited or unavailable.

How It Works

- Pre-Qualify with multiple lenders using soft-pull credit checks

- Compare offers and select which loans to accept

- Stack loans strategically—often within a short timeframe

- Receive funds from each lender individually

- Manage multiple repayment schedules over 1–5 years

- Optionally, you may refinance or consolidate later

Varying Interest Rates

6% – 36%

Shorter Terms

1 – 5 years

Combined Loan Amounts

$20,000 – $300,000

Learn how

Personal Loan Stacking works!

Introducing Personal Loan Stacking Programs:

-

- Loan/Line amount: $20,000 – $300,000

- Loan terms: 1 to 5 years

- Interest rates: 6% – 36%

- Collateral: None (unsecured), but some lenders may offer secured options

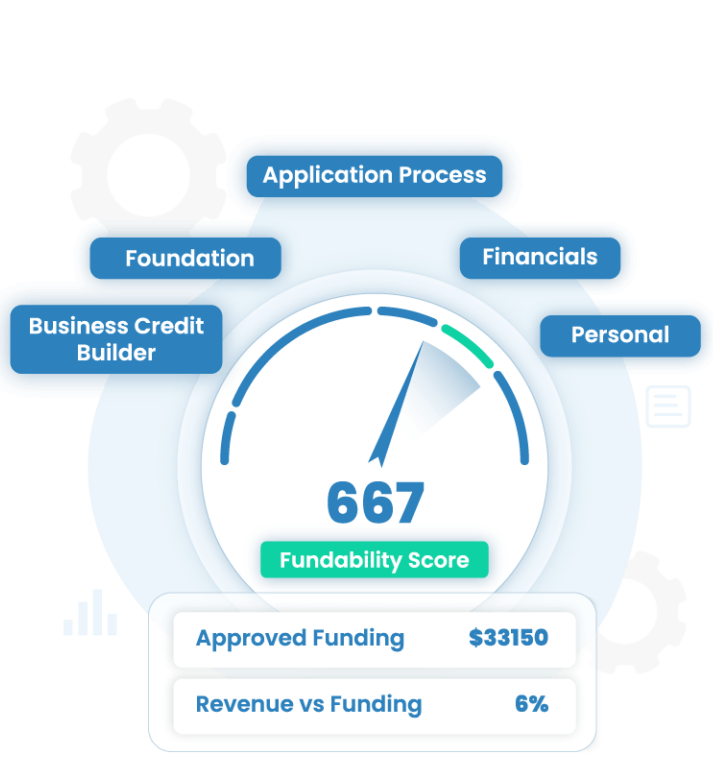

- Credit score: Minimum 680+

Faster Funding’s

Personal Loan Stacking

Access capital with multiple loans

Personal Loan Stacking is a strategy that allows individuals to access significantly larger amounts of capital by obtaining multiple personal loans from different lenders. Instead of relying on a single lender’s maximum limit, borrowers can “stack” multiple approvals to reach a combined funding amount of $20,000 to $300,000.

This method is ideal for borrowers with strong credit and stable income who need rapid access to high-dollar funding for major purchases, investments, business ventures, real estate, debt consolidation, or personal use. While loan stacking offers increased flexibility, it also requires responsible financial management due to the potential impact on credit and cash flow.

Benefits of Personal Loan Stacking

Personal loan stacking allows business owners to combine multiple personal loans to access larger amounts of capital when traditional business financing isn’t an option. It offers fast approvals, flexible use of funds, and no business collateral requirements, making it a practical solution for startups, short-term needs, or gap financing while preserving business cash flow.

- Access higher funding than any single lender would offer

- No collateral required for most stacked loans

- Fast approvals—often same day or next day

- Flexibility to structure financing across multiple lenders

- Competitive rates for qualified borrowers

- Can be used for personal or business purposes

Qualification Requirements

Borrowers must generally meet the following:

✔ Basic Personal Requirements

- Must be 18 years or older

- Must be a U.S. citizen or permanent resident

- Must have a verifiable bank account

- Must have a valid government-issued ID

✔ Income & Employment Requirements

- Must have a stable source of income

- Proof of employment may be required

- Borrower must demonstrate repayment capacity

✔ Credit Requirements

- 680+ credit score is recommended to maximize approvals

- Clean payment history preferred

- Lower scores may qualify but at higher rates and fewer approvals

✔ Financial Requirements

- Debt-to-Income Ratio (DTI) must meet lender limits

- Lower DTI increases total borrowing potential

- Existing obligations may reduce additional loan approvals

Collateral Requirements

Most personal loan stacking strategies use unsecured personal loans, requiring:

- No collateral

- No home or vehicle risk

However, borrowers may choose to include:

Secured Loan Options

Some lenders may offer lower rates or higher approval amounts when using collateral such as:

- A vehicle

- Real estate

- Savings or investment accounts

Collateral is optional, not required.

Risks & Considerations

While personal loan stacking is highly effective for accessing large amounts of money, borrowers should be aware of:

- Potential credit score impact from multiple inquiries and higher total debt

- Multiple monthly payments

- Higher overall interest costs

- DTI ratio increases, making future loans harder to qualify for

Borrowers should only use this strategy if they have strong financial discipline and a clear plan for repayment.

How We Work. Our Mission & Values

At Faster Funding, we’re committed to helping businesses of all sizes succeed. Our Personal Loan Stacking programs are just one of the many ways we’re working to make that happen.

To learn more about our Personal Loan Stacking Loans or to apply for other types of funding, please contact us. Our team of experts is standing by to help you find the perfect lending solution for your business.

Faster Funding is Here to Help

Frequently Asked Questions

We understand you are probably wondering how this all works. Here are some key topics to help you make informed decisions to unlock your business’s growth opportunities.

Can I stack personal loans with bad credit?

Loan stacking typically requires 680+ credit, though some lenders may approve lower scores at higher rates.

How fast can I get the funds?

Many lenders offer same-day or next-day funding once approved.

Is this legal?

Yes. Loan stacking is legal when done transparently. Borrowers must provide accurate financial information to each lender.

Can these loans be used for business?

Yes, many borrowers use stacked loans for real estate, investing, business startups, or expansion.

Get Started

Contact us to learn more about our personal loan stacking programs. Our team of experts is standing by to help you find the perfect financial solutions for your business.